As energy companies retreat from exploration in the Arctic,Italy’s Eni SpAoutlines the final preparation of the Goliat platform, the world’s largest and most sophisticated circular FPSO, which is well under way in the Barents Sea. Eni is set to begin pumping at its Goliat platform before the end of this year. It would open a flow that will eventually reach 100,000 barrels a day and place Eni among a select group of oil producers in the region.

"Goliat" will be the first oil field to come on stream in the Barents Sea, and is the world’s most northerly offshore development, nearly 300 miles north of the Arctic Circle. The Goliat field is located in production licence 229 (PL229) which was awarded in the “Barents Sea Round” in 1997. The licensing round was initiated by the authorities in order to promote interest in the Barents Sea as an oil and gas region. The discovery was made with the first exploration well in 2000.

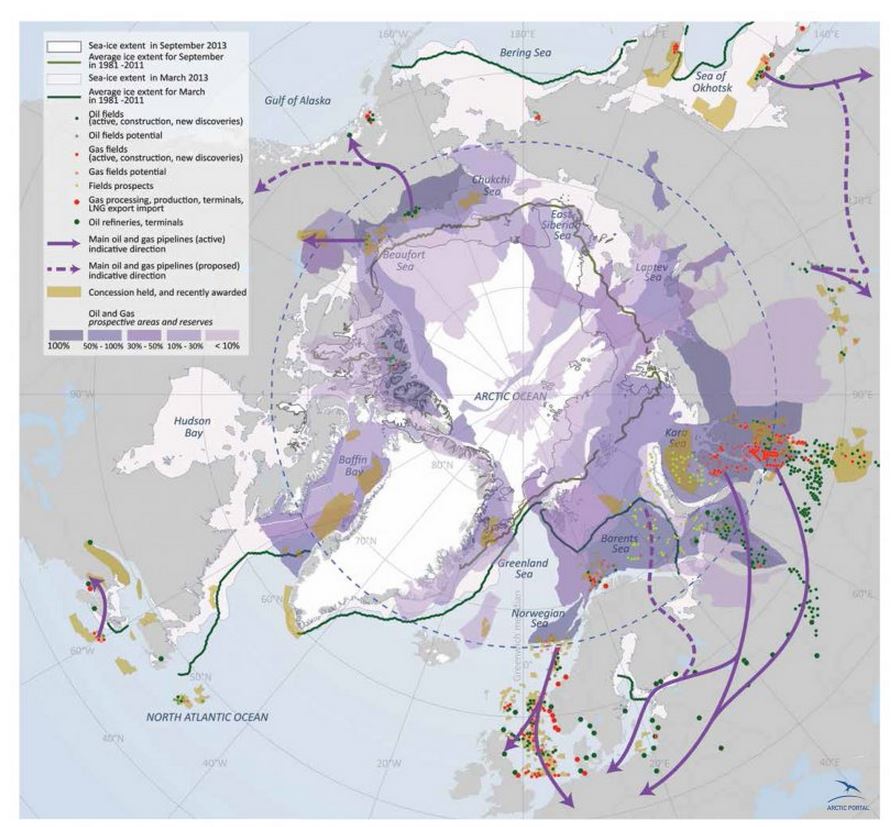

ENI'decision to continue its operation far North goes against the grain, as several energy company recently retreated from exploration in the Arctic. For instance, last September, Royal Dutch Shell retreated from searching for oil within the Arctic Circle off Alaska’s coast after it failed to find enough crude, while just few days ago Statoil, as the leases in the Chukchi Sea are no longer considered competitive within Statoil’s global portfolio, made the decision to exit the leases and close the office in Anchorage, Alaska.

Eni Chief Executive Claudio Descalzi says the Barents Sea is “a completely different kind of Arctic than northern Alaska” because the former is free of ice and is near a populated area where oil companies have been exploring for two decades. Indeed, Goliat doesn’t have to contend with a frozen sea or rogue icebergs because warm water from the south ensures a more temperate climate".

In addition, as reported by the Wall Street Journal, "for Eni, the $6 billion Goliat project was too far advanced to be called off" The project, though, comes with a host of problems, given that it is already 50% over budget and two years behind schedule. When Eni gave the final green light to Goliat in 2009, Brent crude traded at roughly $70 a barrel and rose to $126 a barrel, two years later. Today, Brent, the global benchmark for oil prices, is treading above $40.

“You have to be ready to always be able to work at $40 or $50 a barrel,” Mr. Descalzi said. “Then if oil is at $110 you will have great profits you can invest. If it falls to $20 or $30, you forget about oil and use coal.”

Goliat can break-even with Brent averaging $55 a barrel over the expected 15-year life of the oil field, said Mr. Descalzi, a career oil man who worked his way up through Eni’s ranks over a 35-year career and took the helm last year.

Analysts are less sanguine about Goliat’s prospects. Credit Suisse says Goliat’s break-even point is above $100 a barrel. Citigroup reckons that without the delays and cost overruns Goliat would have been profitable with oil at $75 a barrel, but now needs a break-even level of $122.

(source: ENI NORGE, Wall Street Journal)